Certificate of uncollectibility: Everything you need to know

With the forthcoming end of state aid, the increase in unpaid invoices in France will continue to rise and with it the increase in bad debts.

Also, you can still apply for a certificate of uncollectibility if one of your debtors leaves you with an unpaid invoice and all your collection attempts have failed. This document attests to the uncollectibility of your debts. It allows you to rule on the irreversible loss of this one and to ask for the refund of your VAT to the tax authorities if you have already paid it.

This document can be provided to you by a collection company and under certain conditions. We take stock.

What is a certificate of uncollectibility?

The certificate of uncollectibility is an official document that is issued upon request by the creditor. This document attests and certifies that the debt is uncollectible.

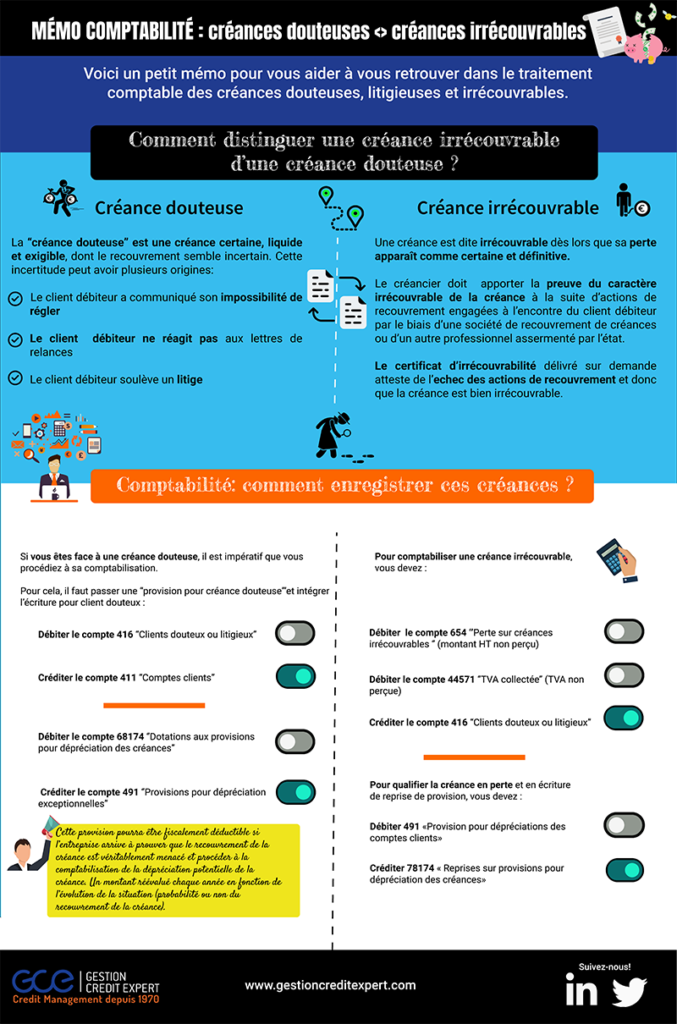

What is an uncollectible debt? Small reminder

A debt is said to be irrecoverable when its loss is certain and definitive. The creditor must justify the irrecoverable nature of the debt and the failure of the actions carried out beforehand to recover its unpaid debts from its client-debtor.

What is a claim to find out in this article.

What is the purpose of a certificate of uncollectibility?

The certificate of uncollectibility allows :

- Prove the irrecoverable nature of the unpaid invoice

- Reclassify this claim as a final loss

- Recover the corresponding VAT (Value Added Tax)

Moreover, the principle of this certificate is in line with tax requirements, according to article 272-1 annex IV and article 48 of the General Tax Code. Specifically, VAT collected on cancelled or terminated services or sales must be charged or refunded under the conditions set forth in Article 271, once the corresponding receivables have become definitively irrecoverable.

Attention: a doubtful debt does not allow VAT to be recovered. This is why the certification of bad debts is of major interest.

How to obtain a certificate of uncollectibility?

The certificate of uncollectibility can be sent to the creditor by professionals recognized by the State:

- Collection companies

- The judicial liquidators

- The bailiffs

Please note, if you have carried out an amicable recovery procedure or legal debt recovery and it has failed, this is not enough to make your unpaid debt irrecoverable.

When can the certificate of uncollectibility be sent?

This document is provided in the following cases:

- Judicial liquidation of the debtor

- Payment by stolen or NSF cheque

- Personal recovery procedure of the debtor in progress

- Debtor left without leaving an address

- Insolvent debtor, when it is established that he/she is a beneficiary of solidarity allowances or unseizable income

- Debtor deceased, estate void or unidentified

How to account for a bad debt?

In order to reclassify your unpaid invoices as uncollectible, several accounting entries are required.

Accounting entry for uncollectible receivables

In order, here is how to operate:

- Debit of account 654 which corresponds to “Losses on bad debts

- Debit of account 4457 which corresponds to “Collected VAT

- Credit to account 416 “Doubtful or disputed customer

- Debit of account 491 “Depreciation of accounts receivable

- Credit to account 7817 “Reversal of depreciation of current assets

This reclassification of the receivable will allow you to recover the corresponding VAT from the competent tax authorities, in accordance with the conditions set out inArticle 271 of the General Tax Code.

Tip: If you need a concrete example to help you reclassify your receivable as a loss, please visit the website compta-facile.com. It is a very well-designed site which covers all the current accounting entries of a company and which offers diagrams and concrete explanations.

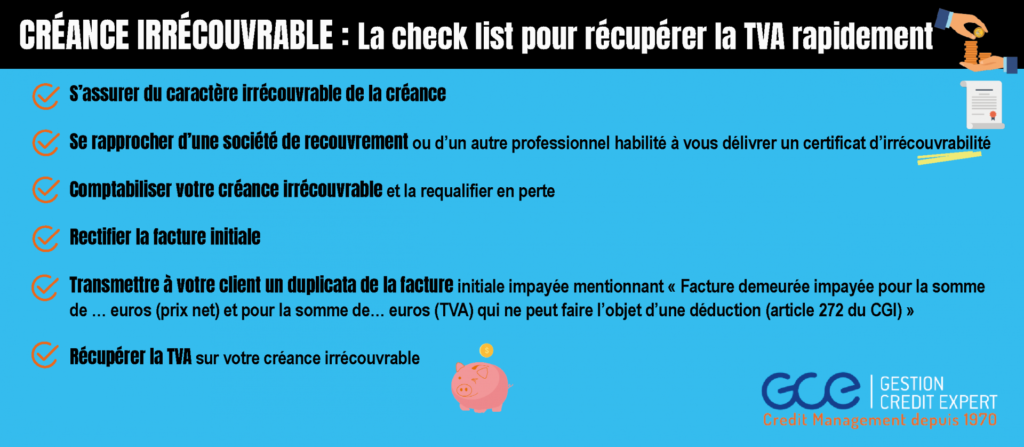

Bad debts: how to recover VAT?

Whena receivable is proven to be uncollectible, the corresponding loss is deductible from the profit or loss for the year. But that is not enough. It also requires the prior rectification of the initial invoice.

Steps to recover VAT on a bad debt

You will have to send to your customer a duplicate of the initial unpaid invoice mentioning “Invoice remained unpaid for the sum of … euros (net price) and for the sum of … euros (VAT) which cannot be the subject of a deduction(article 272 of the CGI)”.

Please note:

- In the event of a tax audit, you must present the certificate of uncollectibility and the duplicate of the unpaid invoice

- If you have several claims against the same debtor customer, you will be able to send him a summary statement of all unpaid invoices which will replace the numerous duplicates.

In the case of a judicial liquidation of your client, the tax can be charged or refunded on the date of the judgment pronouncing the liquidation.

Finally, if you have any other questions regarding the certificate of uncollectibility and debt collection procedures, please contact us.