How to calculate the DSO?

The DSO, or average payment period, is an indicator that requires particular vigilance on the part of companies. The higher the DSO, the more the company's cash flow is put at risk. Minimizing the DSO is one of the priorities of an accounting department. Find out how to calculate a DSO and secure your cash flow.

What is DSO? Definition

DSO (Average DSO – Daily Sales Outstanding) is a key indicator of a company’s cash management performance. It measures the number of days it takes to collect payments due from customers after the date the invoice is issued. In other words, calculating DSO means calculating the average duration of your company’s customer loans.

How to Calculate DSO – Definition and Calculation | GCE

The DSO provides important accounting information about sales that have been invoiced but are still pending collection.

Calculated in number of days, it is sometimes referred to by the acronym NJC (Number of days of customer credits).

What are the elements of the DSO calculation?

The calculation of DSO is an essential indicator to integrate into your accounting to monitor the financial health of your company.

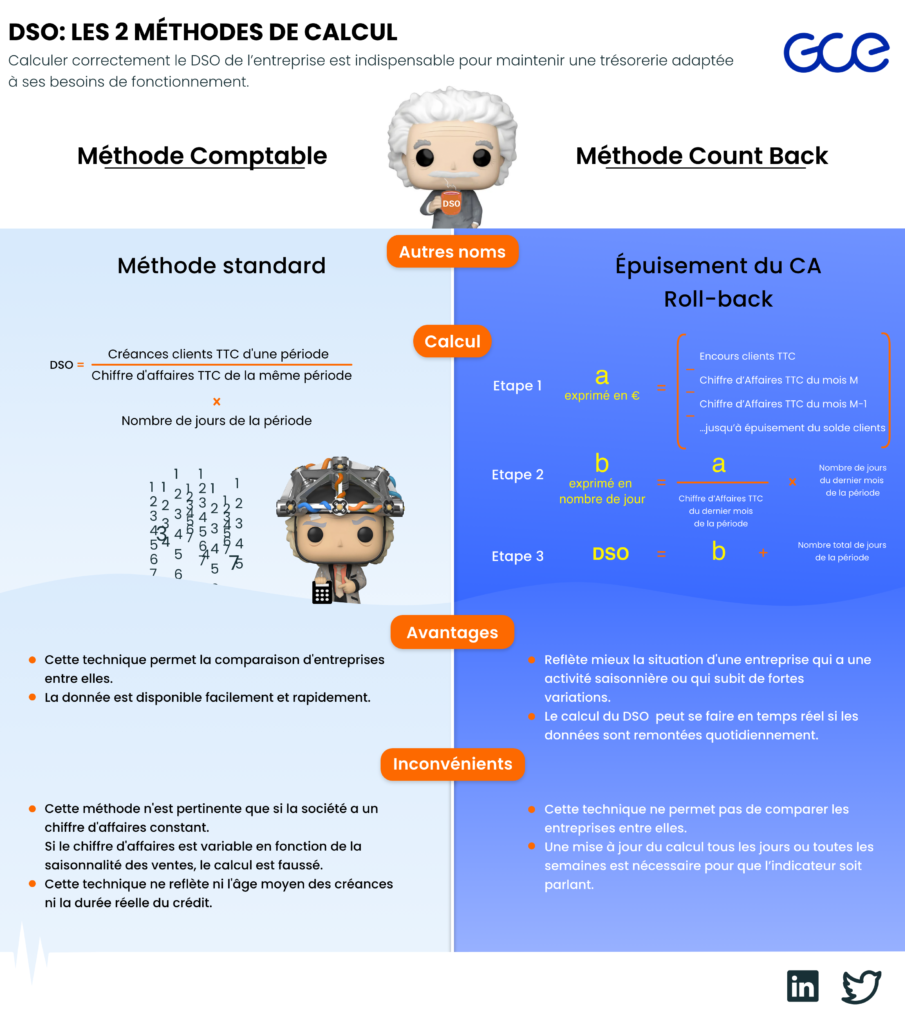

There are two ways to calculate your DSO.

1) Calculate your DSO by the accounting method

Calculating your DSO using the accounting method involves two steps:

- Establish the ratio of your total accounts receivable (including VAT) to your sales (including VAT) over a given period (i.e., accounts receivable including VAT ÷ sales including VAT).

- Multiply this ratio by the number of days in the specified period.

Example to understand:

Here is the calculation of the DSO of a company with an outstanding customer amounting to 20 000 € for a turnover of 45 000 € including VAT over a period of 3 months (90 days):

(20 000 € ÷ 45 000 €) x 90 d = 40 days

This result indicates that on average, in this company, customers take 40 days to pay the amounts due.

This method of calculation is simple and allows us to differentiate between two types of DSO:

- The DSO of invoices not yet due: that which concerns invoices whose due date has not yet passed.

- The DSO of overdue invoices: that which concerns late payments by customers, i.e. beyond the contractual deadline.

However, it has the disadvantage of not taking into account seasonality or significant variations in sales.

2) Calculate your DSO using the countback method

This DSO calculation formula provides a more accurate view of your customers’ payment times. It shows you the real time of payment of your customers, taking into account the fluctuations of your turnover related, for example, to the seasonality. It is a question of deducting from the amount of the outstanding customers, the turnover including VAT of each month then, in parallel, to add the number of days of the corresponding months, the whole until exhaustion of the outstanding.

Example to understand:

For the month of January, your outstanding receivables amount to €40,000 including VAT.

⇨ January (31 days): Your sales including VAT are €25,000. 40 000 € – 25 000 € = 15 000 €. There are 15,000 € of outstanding customers.

⇨ February (28 days): Your sales including VAT amount to €20,000. 20 000 € – 15 000 € = 5 000 €. There is still €5,000 in outstanding receivables.

⇨ March: Your turnover including VAT is 12 000 €. You divide the outstanding balance by the month’s sales including tax, then multiply the result by the number of days in the month: (5,000 ÷ 12,000) x 31 = 12.9. The outstanding customer balance will be exhausted on March 13.

⇨ Total DSO calculation: 31 days + 28 days + 13 days = 72 days.

The average payment term for your customers is 72 days.

Although more complex, this formula allows you to accurately calculate the DSO for your entire customer base, a group of customers or a single customer. Through this method, you will be able to have a finer vision of your customer position and define an action plan more suited to your customer segmentation to manage it effectively.

Regardless of the approach you choose to calculate your DSO, the calculation elements remain the same: sales, outstanding receivables and the number of days in the study period.

Importance of DSO for your business

The DSO is an indicator of the financial health of your business . It provides information on the speed and efficiency of your dunning and debt collection processes. If your DSO is high, it indicates that your customers are taking a long time to pay.

On the other hand, if your DSO is low, it means that the invoices issued are collected quickly. The shorter the time it takes for your customers to pay invoices, the lower your working capital requirement (WCR) . This means that you have sufficient financial resources to cover the ongoing costs of your business. Correctly calculating your DSO is therefore essential to maintain a cash flow that is adapted to your company’s operating needs.

Some tips to reduce your DSO

As you can see, a low DSO reflects the speed of your customer payments and relieves your cash flow and working capital requirements.

For To reduce DSO, several effective techniques can be implemented at different levels of the sales-to-cash chain: sales policy and payment terms granted, down payment policy, type of invoicing, advancement process, dunning methods, management of the debt collection If you feel that your DSO is too high, you can :

- Renegotiate shorter payment terms with your current customers.

- Impose reduced payment terms for each new customer.

- Issue and send your invoices as quickly as possible.

- Require a deposit at the time of order

- Offer benefits or discounts to convince your customers to pay their bills more quickly.

- Actively follow up with your customers on a regular, systematic and timely basis

- Identify disputes and process them more quickly

- Set up an efficient and effective invoice collection process with actions that are monitored and timed

Conclusion DSO is a good indicator of the financial health of a company. The faster a company gets paid by its customers, the better its cash flow… any means to improve DSO is therefore good to take, including the handling of unpaid invoices by a debt collection agency.

To ensure that your efforts to optimize your DSO remain effective over time, monitor its evolution regularly. Set up comprehensive and readable reports to be followed every month for example.

If, in spite of the strategies put in place to accelerate the payment of issued invoices, you continue to be confronted with late payments or even unpaid invoices when the due date has not yet been paid, call upon a debt collection company . Companies like GESTION CREDIT EXPERT know how to advise you on the management of your accounts receivable and take charge of your unpaid invoices.

Calling on experts specialized in credit management is the ideal alternative to quickly increase your cash flow and reduce your customer credit risks.