Billing: what are the obligations of companies?

Invoicing is an essential step for companies. The legislation on this subject is strict. There are clear rules to follow in the process of editing and sending invoices. We offer you a summary of the obligations to follow and the new rules applicable from October 1, 2019. These new features will help to speed up invoice processing and reduce payment times.

Invoicing, a rigorous step that must be respected

Invoicing consists of creating a commercial and accounting document on which there is a precise and detailed note of the products sold or the services provided, and of their conditions of purchase and sale.

For the professions, the invoice is called a “bill of fees”. They are subject to the same legal rules and obligations as invoices.

An invoice can be corrected or cancelled if it contains an error. To do this you need to:

- Issue a new invoice to replace the previous one. The replaced invoice must be listed on the new invoice.

- Establish a credit note with reference to the invoice to which it relates.

However, it is impossible to delete it.

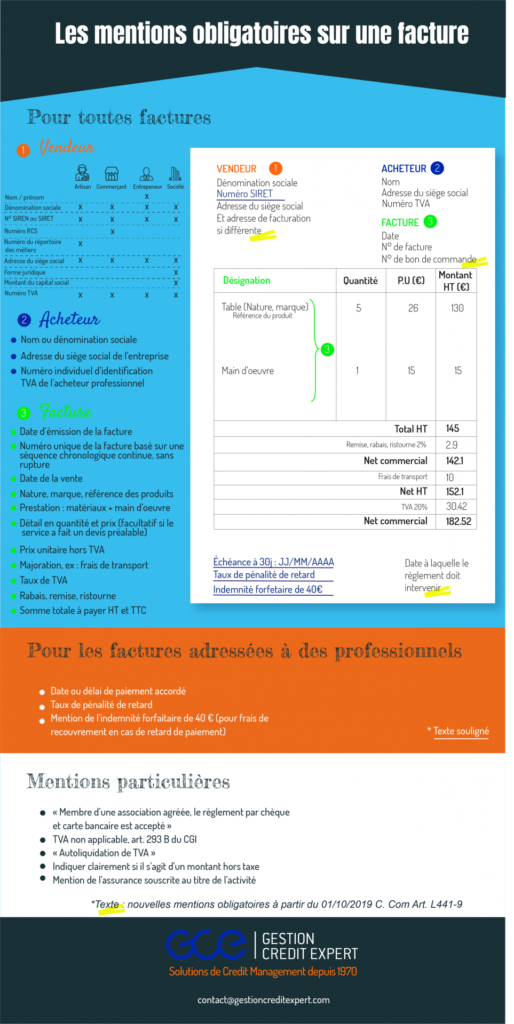

Mandatory information on the invoice

An invoice must be written in French, established in two copies in paper or electronic format, and include all the mandatory information.

Furthermore, Order 2019-359 of April 24, 2019 introduced two new information that must appear on invoices issued:

- The billing address when it is different from the address of the parties,

- The purchase order number if it has been previously established by the buyer.

What are the rules in terms of invoice transmission

The seller is obliged to issue the invoice to the customer as soon as the delivery or service has been performed.

Since October 1 , 2019, the buyer, if he has not received an invoice, is now required to request it.

In principle, companies send their invoices to customers in paper form by post or hand-deliver them directly.

It is also possible for professionals to send them electronically, provided that the client accepts this method of sending. This process is interesting for companies that dematerialize their invoicing process.

Sanctions applicable in the event of non-compliance with invoicing rules

In case of failure to invoice (total absence of invoicing), omission of information, or inaccuracies, the fines can be heavy. The April 24, 2019 order defined new administrative penalties:

- 75.000 € for a natural person,

- 375.000 € legal entity,

- In the event of a repeat offence within 2 years, the fine is doubled.

Invoicing rules, an opportunity to reduce customer payment times

The first step to getting paid on time is the quality of the billing process. The more rigorous you are in the process of editing and sending your invoices, the shorter the payment terms will be. Elements such as the order or contract reference can be useful, even indispensable: the customer can easily match the order to the corresponding invoice received, and thus validate it as “good to pay”. In some companies, if this element is missing, the invoice cannot be processed and must be sent back to the supplier, thus extending the payment period.

In addition to the additional information that is now mandatory, the accuracy of the information on the invoice is essential: it often happens that the customer’s address is incomplete or even wrong. This means that the invoice is more likely to get lost and payment times are more likely to increase.

Do you want to know more about good invoicing practices in a constantly changing regulatory framework?

Do you want to optimize the collection of receivables?